Are you ready to take on the challenge and become a successful trader? Then you need to have the right trading system in place. In this blog post, I will introduce you to my best Forex EA that helped me pass the FTMO challenge. Not only that, but I will also demonstrate how you can use it to pass the challenge with ease.

Before we get started, let me introduce myself. My name is Sam Barbosa , and I am excited to share with you my Forex Robot for EURUSD. This robot is quite simple, yet effective. It will open long trades whenever the price goes below the envelopes and short trades when it goes above them. The period is set to 25, and the deviation is set to 0.35. I use a stop loss of 30 pips and take profit of 75 pips.

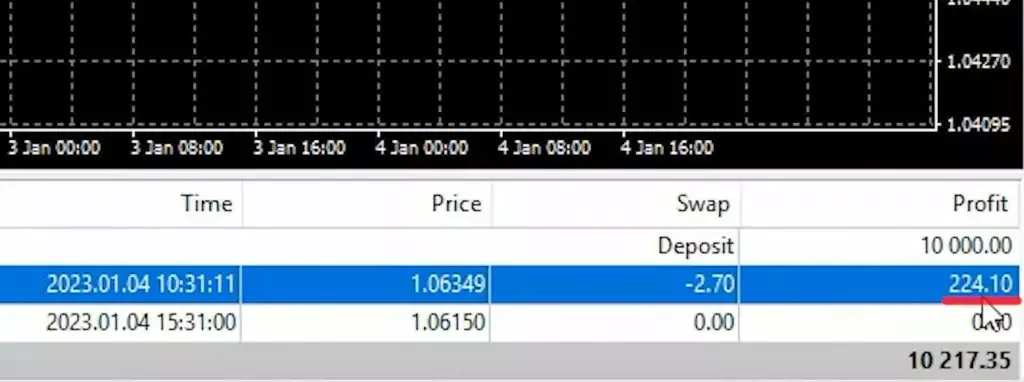

Let me give you an example of how the Forex Robot works. I placed a long trade when the price was at 105.60. My stop loss was set at 105.30, and my take profit was reached at 106.35. At the top of the candlestick, the trade was closed, and I made a profit of $224. Since the price was already above the envelopes, the robot opened a short trade at the opening of the next bar. The entry price was 106.15, and my stop loss was set at 106.45, and my take profit was set at 105.40.

Unfortunately, due to red-hot economic news, I had to close the trade. However, I placed my stop loss at the break-even, giving the trade a chance to go in the right direction before the news. The Forex Robot uses a scaling method that helps you pass the FTMO challenge with just two trades. The maximum risk per trade is just 1%, and the target profit is 2.5%.

It is essential to have proper money management when trading. In the FTMO challenge, I risked a maximum of 1% per trade and targeted a profit of 2.5%. If the stop loss hit, I lost 1%, but if the take profit hit, I made a profit of 2 to 2.5%. If I reinvested the profit and risked 1% again, I could potentially make $875 in a 10K account. However, it is important to note that this is not financial advice, and you should take responsibility for your own risk management.

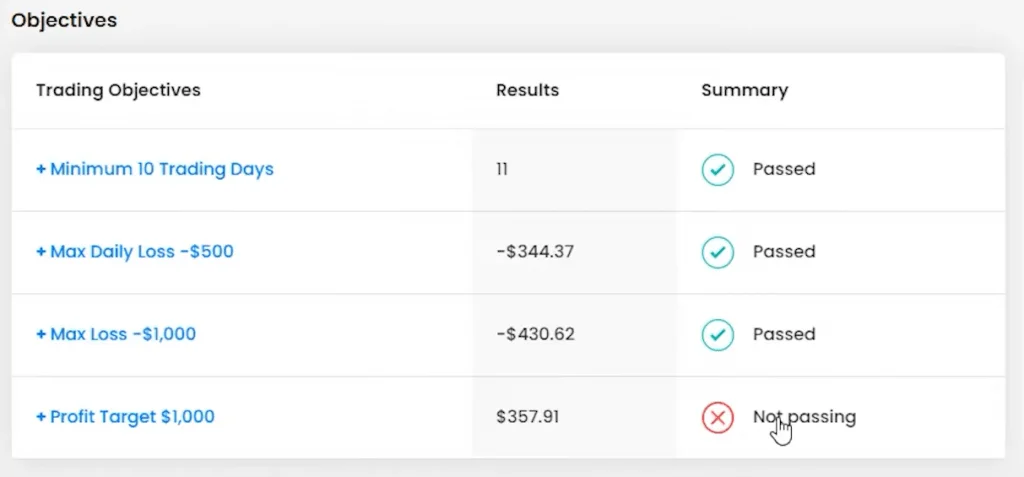

If you’re curious to know more about the challenge and its features, simply click on “See all Features.” There, you will find valuable information such as the daily drawdown, maximum trailing drawdown, leverage ratio (1 to 30), and the availability of both MT4 and MT5 platforms. Personally, I find the compatibility with MT4 and MT5 platforms extremely beneficial as it allows me to trade seamlessly with the Forex Robot.

Now, let’s take a closer look at some of the results achieved using the Forex Robot. On the third day of the challenge, I experienced a 2% drawdown.Despite seeming like a setback, this outcome actually pleases me as it allows me to showcase a realistic example. Passing the challenge solely with two consecutive trades is indeed possible using the scaling system I previously explained. However, in this specific challenge, I already had one profitable trade, and while scaling up, I hit the stop loss. Additionally, I encountered another stop loss earlier this morning, resulting in a 2% drawdown.

During the challenge, it’s crucial to be mindful of economic news events that can significantly impact the market. For instance, the Non-farm Employment Change is a significant announcement that affects the US dollar. As an FTMO trader, I’m required to refrain from executing trades in the window before and after the release of major news events. This is a precautionary measure to ensure responsible trading. If you’re trading with a funded account, it’s essential to exercise caution during such news events and pay attention to other influential factors like the Federal Fund Rate, Advanced GDP, FOMC meeting minutes, and CPI.

As we approach the end of the week, I typically pause trading two hours before major news events. Since it’s currently Friday, I’ll be temporarily removing the Forex Robot from my chart. This allows me to avoid any potential adverse market movements resulting from the news events. During the challenge, it’s essential to be aware of any news releases that can affect the market’s volatility. For example, on the day of recording, there was a non-farm employment change, which resulted in our Forex EA being disabled before and after the release. It’s crucial to pay attention to such news releases and adjust your trading strategy accordingly.

When analyzing price movements, it’s important to pay attention to chart patterns and candlestick formations. In this example, we can see that the price on the hourly candlestick moved from 105 to 105.30, experiencing several ups and downs. By switching to the M1 chart, you can observe how the price reacted to a news release.

During a trading challenge, it’s crucial to consider the placement of your stop loss.If you set your stop loss too close, typically between 20 to 30 pips, volatile market conditions are likely to trigger it.. In some cases, the price may reverse in your favor after hitting the stop loss. Therefore, it’s advisable to stay away from the market during high volatility events, such as the Non-farm Employment Change.

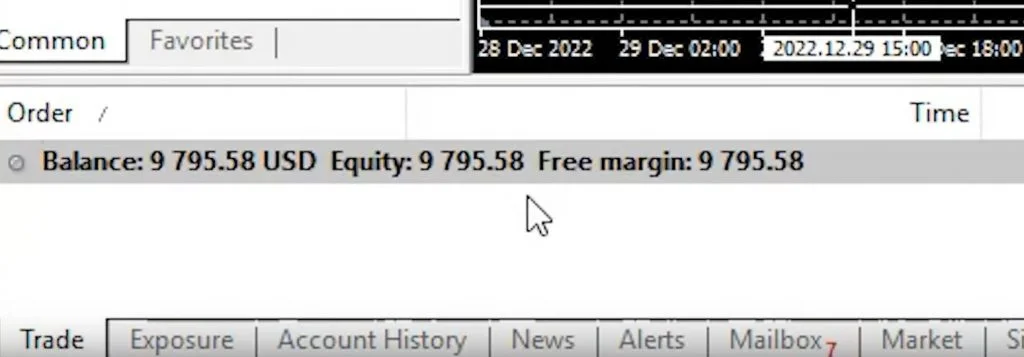

At the end of the month, it’s essential to analyze your trades and evaluate your performance. In this case, after a series of losing trades, followed by hitting stop losses and take profits, the challenge objectives were not fully met. However, it’s important to note that not reaching the profit target is normal, as long as you fulfill the other trading objectives.

If you find yourself in a situation where you haven’t reached the profit target but are still on a profitable trajectory, you can request a free retake. By meeting the first three trading objectives and having a minimal profit, you qualify for a free retake. It’s crucial to communicate with the challenge provider and follow their guidelines.

I successfully passed the free retake challenge with just two trades using the same Forex EA in this scenario.. I executed the trades in quick succession, starting with a long trade and followed by a short trade.. These trades resulted in a balance of $11,039, exceeding the required 10% profit target. After fulfilling the minimum trading days, I manually placed additional trades to meet the trading criteria.

During a trading challenge, it’s crucial to consider the placement of your stop loss.If you set your stop loss too close, typically between 20 to 30 pips, volatile market conditions are likely to trigger it.. In some cases, the price may reverse in your favor after hitting the stop loss. Therefore, it’s advisable to stay away from the market during high volatility events, such as the Non-farm Employment Change.

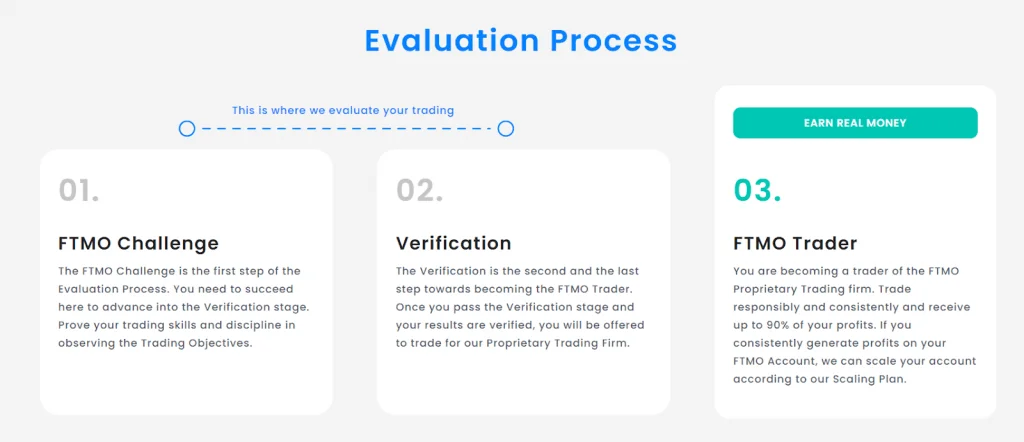

Once you have successfully passed the trading challenge, the next step is the verification process. It’s crucial to follow the specific requirements and guidelines provided by the challenge provider. This process ensures that your trading strategy is consistent and profitable over a more extended period.

To enhance your trading skills and knowledge, consider exploring additional resources. The FTMO Masterclass is a comprehensive course that many traders have found beneficial. As a subscriber, you can access a special discount coupon provided in the description below. Additionally, you can test the recommended Forex EA for free, but make sure to evaluate it thoroughly on a demo or during the free trial period offered by FTMO.

Participating in a trading challenge offers an exciting opportunity to showcase your trading skills and potentially receive funding. By incorporating the best Forex EA into your trading strategy, you can automate your trades, eliminate emotional biases, and increase your chances of success. Remember to analyze your trades, learn from your experiences, and make use of any available options like free retakes. Keep learning, improving, and following the guidelines provided by the challenge provider to pass the verification process successfully. Happy trading!